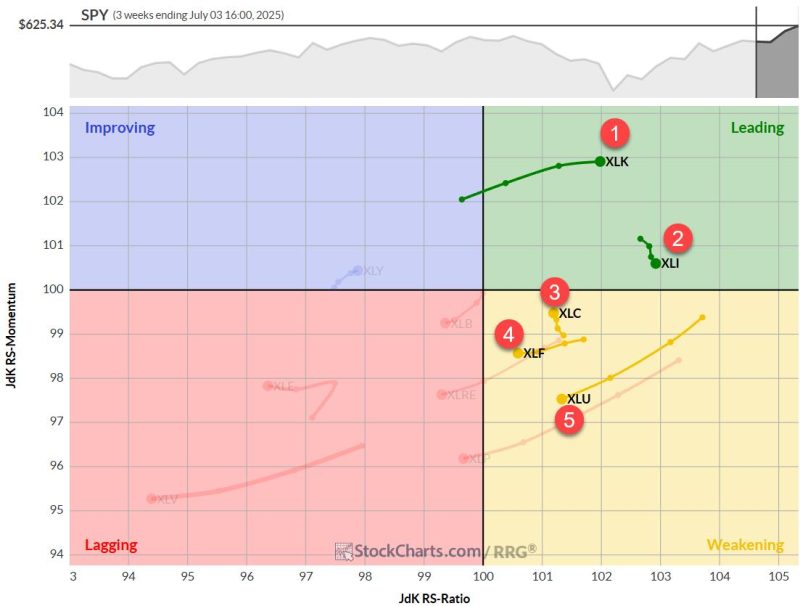

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we’re seeing some interesting shifts within the rankings that warrant closer examination. Let’s dive into the details and see what the Relative Rotation Graphs (RRGs) are telling us about the current market dynamics.

Sector Rankings Shuffle

The top three sectors, technology, industrials, and communication services, remain firmly entrenched in their positions. But the real action is happening just below them. Financials climbed to the number four spot, consequently pushing utilities down to fifth place. This shift is significant, as it indicates a move towards more cyclical sectors in the top rankings.

These changes suggest a potential shift towards more economically sensitive and offensive sectors, which supports a bullish scenario or at least a move away from defensive positioning.

- (1) Technology – (XLK)

- (2) Industrials – (XLI)

- (3) Communication Services – (XLC)

- (5) Financials – (XLF)*

- (4) Utilities – (XLU)*

- (8) Materials – (XLB)*

- (7) Consumer Staples – (XLP)

- (6) Real-Estate – (XLRE)*

- (10) Consumer Discretionary – (XLY)*

- (9) Energy – (XLE)*

- (11) Healthcare – (XLV)

Weekly RRG

The weekly Relative Rotation Graph continues to show strength in the technology sector within the leading quadrant. Industrials is also maintaining its position in the leading quadrant, with a very short tail, indicating a consistent relative uptrend.

Communication services, financials, and utilities are currently in the weakening quadrant. However, communication services have rebounded and appear to be making their way back towards the leading quadrant again.

Financials and utilities, on the other hand, are showing negative headings, with utilities displaying the weakest momentum (longest tail).

Daily RRG

Switching to the daily RRG, we get a more granular view of recent sector movements:

- Technology remains the strongest sector, with a high RS ratio and a short tail

- Communication services are rotating at a slightly negative heading but still within the leading quadrant

- Financials and industrials are showing promise in the improving quadrant

- Utilities continues to rotate within the lagging quadrant, confirming its weakness

The positioning of these sectors, particularly the strength of technology and improvements in financials and industrials, suggests a shift towards more cyclical and less defensive sectors in the market.

Technology

Tech continues its rally after breaking above the $240 resistance area. The raw RS line is also climbing, having broken out of its falling channel. This sector remains the market leader and shows no signs of slowing down.

Industrials

The industrial sector has cleared its overhead resistance and is pushing higher. Its RS line is putting in new highs, reflecting strong relative performance. The RRG lines remain in the leading quadrant and may be turning up again, a bullish sign.

Communication Services

Comms have broken above their resistance around 105. While still at the lower boundary of its rising RS channel, it’s starting to pick up steam. Both RRG lines are climbing, with RS momentum approaching the 100 level. A cross above that level would put it back in the leading quadrant.

Financials

Financials broke through overhead resistance last week, which is a significant positive development. It’s now above both horizontal resistance and its former support line. The relative strength line needs some work, but with the current price breakout, improvement seems likely in the near future.

Utilities

The weak link in the top five, utilities, remains range-bound. It’s still above support, but not by much. With the broader market rising, utilities’ sideways movement is causing its RS line to drop. The RRG lines are rolling over, and we may soon see this sector rotate into the lagging quadrant on the weekly RRG.

Portfolio Performance Update

I must admit, our portfolio is still underperforming. The current drawdown is a little over 8%, which isn’t ideal. However, this is the nature of trend-following strategies. We’re sticking with our approach through this period of underperformance, confident that historical results support our patience.

If market trends continue as they are, we should see more offensive sectors rotate into the top five. This shift, in turn, should help us overcome the current drawdown and eventually bring us ahead of the S&P again.

Remember, investing is a marathon, not a sprint. Periods of underperformance are normal and to be expected. The key is to stay disciplined and trust in your strategy.

#StayAlert and have a great week. –Julius