Sector Shake-Up: Defensive Moves and Tech’s Tumble

Last week’s market volatility stirred up the sector rankings, with 6 out of 11 sectors changing positions. While the top three remain steady, we see a clear rotation from cyclical to more defensive sectors. Let’s dive into the details and see what the charts tell us.

The weekly sector ranking has undergone some significant changes. Communication Services (XLC) is holding firm. Financials (XLF) is maintaining position. Consumer discretionary remains steady, but is showing weakness. Consumer Staples (XLP) is the new entrant to the top 5, while Utilities (XLU) Holds its ground at #5.

The big story here is the rise of defensive sectors. Health Care (XLV) made a notable jump from 10th to 6th place, while Technology (XLK) took a nosedive from 4th to 10th. This shift is characteristic of the broader shift from cyclical to defensive plays.

The New Sector Lineup

- (1) Communication Services – (XLC)

- (2) Financials – (XLF)

- (3) Consumer Discretionary – (XLY)

- (6) Consumer Staples – (XLP)*

- (5) Utilities – (XLU)

- (10) Healthcare – (XLV)*

- (9) Real-Estate – (XLRE)*

- (7) Industrials – (XLI)*

- (8) Energy – (XLE)*

- (4) Technology – (XLK)*

- (11) Materials – (XLB)

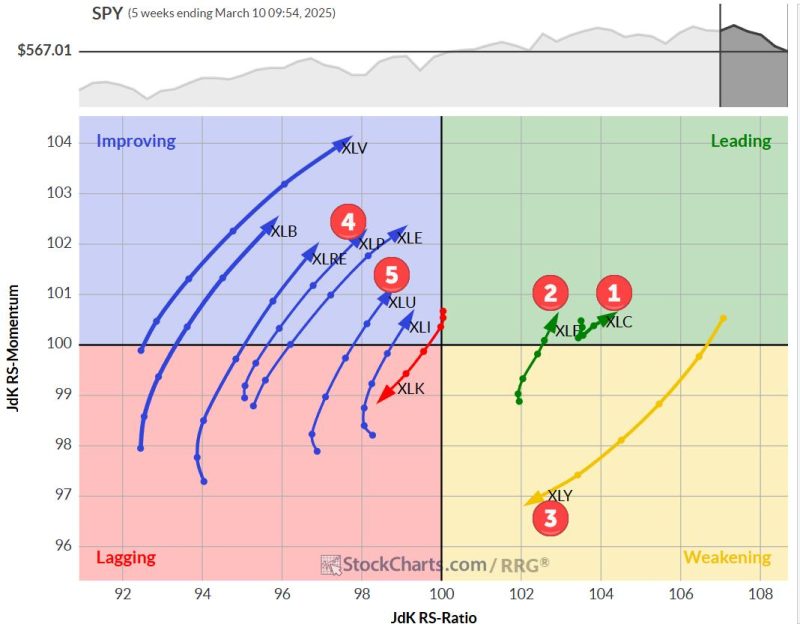

Weekly RRG: A Tale of Two Sides

The weekly Relative Rotation Graph (RRG), printed above, paints an interesting picture. We see only three sectors on the right-hand side of the graph, with the rest clustered on the left. But their movements are telling:

- XLC is in the leading quadrant, moving northeast — a positive sign.

- XLF has turned back up into the leading quadrant, reinforcing its #2 spot.

- XLY is in the weakening quadrant with a long tail, heading towards lagging — a potential red flag.

On the left side:

- XLK’s rotation is clearly weak, pushing further into the lagging quadrant.

- Meanwhile, XLP and XLU show strength, moving with positive RRG headings in the improving quadrant.

Daily RRG: Confirming the Weekly Story

When we look at the daily RRG, we get some additional context:

- XLC has curled up in the weakening quadrant, supporting its positive weekly rotation.

- XLF is confirming its positive move in the leading quadrant.

- XLY is the outlier — its short tail in the lagging quadrant doesn’t bode well for maintaining its #3 position.

- XLP shows the strongest RS ratio reading on the daily chart, complementing its positive weekly movement.

- XLU has lost some relative momentum over the last day, but nothing too concerning at this point.

The Top Five Charts

Communication Services – XLC

XLC is playing around with its old resistance line, now expected to act as support. Monday’s price action shows a slight revival, but it’s too early to call. The relative strength remains robust, with a clear series of higher highs and higher lows on the raw RS line.

Financials – XLF

XLF has broken its rising support line and completed a toppish formation. We’re now eyeing the next support level, around $47.25. Despite this, XLF’s relative performance remains strong, with both RRG lines moving higher.

Consumer Discretionary – XLY

After completing a top formation, XLY is now testing support around 200. It appears to be moving back into its old rising channel — and if my rule holds true, we might see it test the lower boundary. This suggests significant downside risk for the sector.

Consumer Staples – XLP

XLP, the newcomer to the top 5, is pushing against overhead resistance in the $83.50-84 area. A break here could give the sector a significant boost. The improvement in relative strength is already evident, pulling both RRG lines higher.

Utilities – XLU

XLU remains in a sideways pattern, potentially settling into a narrower range between $75.50 and $80.50.

Its relative strength is also range-bound but still pulling both RRG lines up — enough to keep it in the top 5.

Portfolio Performance Update

The technology position was exited and swapped for the consumer staples position against Monday’s opening prices.

As of about 45 minutes after opening, the portfolio performance stands at -3.19% since inception, compared to the SPY benchmark at -3.39%. We’re about 20 basis points ahead — not making a big dent, but keeping pace with the S&P 500 for now.

Going forward, I’ll be including both the performance table and the list of open positions in these articles for better tracking.

Summary

The market’s rotation towards defensive sectors is becoming increasingly evident. Consumer discretionary looks vulnerable, while consumer staples and utilities show strength.

#StayAlert, –Julius