Technology Moves Back into Top-5

As we wrap up another trading week, a notable shift has occurred in the sector rankings.

The technology sector, after a brief hiatus, has clawed its way back into the top 5, pushing energy down to the 7th position. This reshuffle reflects the dynamic nature of market rotations and sets the stage for potential shifts in investment focus.

The New Sector Lineup

- (1) Consumer Discretionary – (XLY)

- (2) Financials – (XLF)

- (3) Communication Services – (XLC)

- (4) Industrials – (XLI)

- (6) Technology – (XLK)

- (7) Utilities – (XLU)

- (5) Energy – (XLE)

- (8) Materials – (XLB)

- (9) Real Estate – (XLRE)

- (10) Consumer Staples – (XLP)

- (11) Health Care – (XLV)

The top-4 and bottom-4 positions did not change. The weakness of the Energy sector has caused Technology to move up into the top-5 and Utilities to take the number 6 spot.

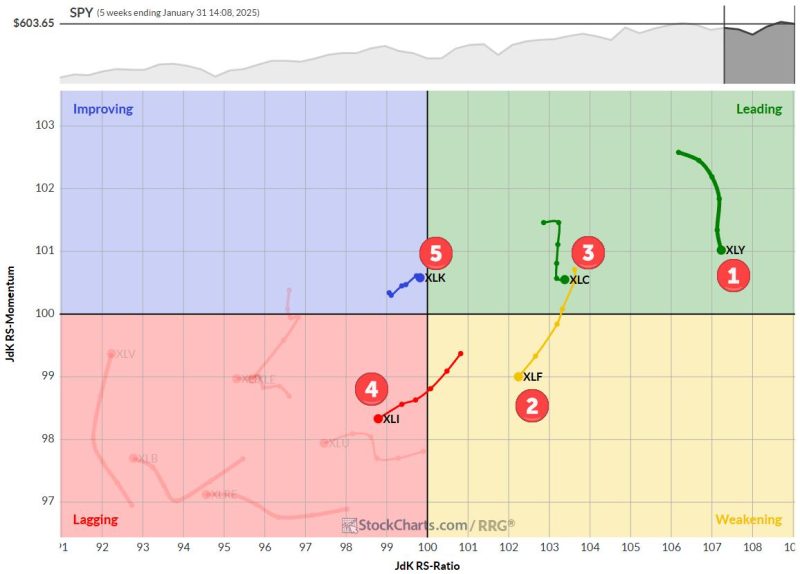

Weekly RRG

On the weekly Relative Rotation Graph (RRG), XLY maintains its position in the leading quadrant with the highest RS ratio, despite some loss in relative momentum.

- XLC, at #3, has halted its momentum loss and shows a slight move to the right, picking up relative strength again.

- XLF (#2) is rotating through the weakening quadrant but still has the potential to turn around.

- XLI (#4) displays a weak tail, pushing into the lagging quadrant, but still outperforms others in that space.

- XLK (#5) remains in the improving quadrant, heading towards leading, a promising trajectory.

Daily RRG

Shifting to the daily RRG, we see some variations that support longer-term trends:

- XLY is rapidly moving back towards leading through the improving quadrant, reinforcing its weekly strength.

- XLF is losing some relative momentum but remains within the leading quadrant.

- XLC shows a strong trajectory back into leading, aligning with its weekly rotation.

- XLI remains in leading but is shedding some relative momentum.

- XLK, while in the lagging quadrant, is starting to curl upwards, bringing its daily tail in-line with the weekly rotation towards the leading quadrant.

Consumer Discretionary (XLY)

XLY is holding up remarkably well, establishing a new higher low of around $218 — a key support level.

Price action suggests a move toward the previous high of $240. Relative strength lines maintain a positive position, underscoring the sector’s dominance.

Financials (XLF)

The financials sector pushed to a new high this week, confirming its bullish condition.

A higher low is clearly in place, and the relative strength chart has bottomed out against former resistance. This setup suggests the RRG lines may turn up soon, imho.

Communication Services (XLC)

XLC is following through nicely after breaking out of a flag-like consolidation pattern.

The sector is now pushing to new highs, dragging relative strength and RRG lines higher and is maintaining a strong rhythm of higher highs and higher lows — a textbook uptrend.

Industrials (XLI)

While XLI remains within its rising channel and has moved away from support, its relative strength is less convincing — neutral at best. However, compared to other sectors, it’s in a relatively good position despite declining RRG lines.

Technology (XLK)

The “new kid on the block” in the top 5, XLK is still capped under the $240 resistance level within its rising channel. Its relative strength line is range-bound and moving towards the lower boundary. RRG lines are slowly picking up.

XLK’s position inside the top 5 seems more due to weakness in other sectors than its strength.

Portfolio Performance

The RRGV 1 portfolio ends the week with a 3.96% gain, outperforming the S&P 500’s 3.4% — an impressive 50 basis points of alpha. I’ll be updating the portfolio on Monday morning, switching out energy for technology based on opening prices.

Summary

While technology has reclaimed its top 5 spot, it’s crucial to recognize that this is partly due to weakness in other sectors rather than overwhelming tech strength. However, as the largest sector, XLK can significantly impact overall portfolio performance. Investors should watch for a potential breakout above $240, signaling further upside.

#StayAlert and have a great weekend. –Julius