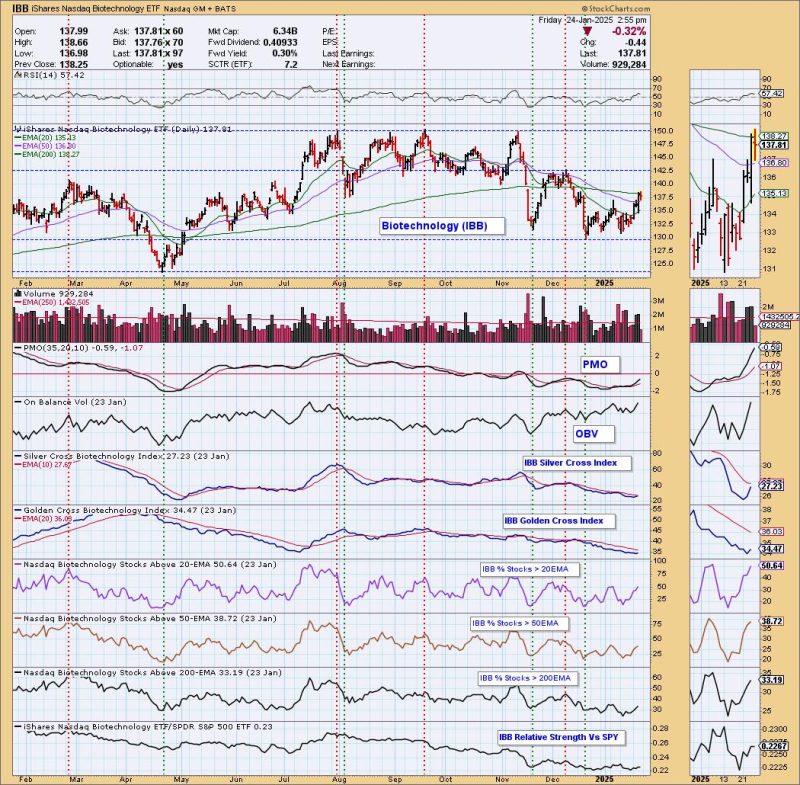

The Biotech industry group is making a comeback, with the ‘under the hood’ chart displaying new strength coming into the group. We have a constructive bottom that price is breaking from and, while it does need to overcome resistance at the 200-day EMA, it looks encouraging. What was particularly impressive was the increase in participation of stocks above key moving averages which is trending higher. A positive close today would likely see these numbers expand.

The Silver Cross Index measures how many stocks have a 20-day EMA greater than the 50-day EMA, or those stocks holding a “Silver Cross”. The Silver Cross Index is moving swiftly higher right now and should see a Bullish Shift across the signal line soon.

We will say that this is a rather aggressive group, so it could turn on us should the market weaken. Stay nimble.

I did a quick scan and found two stocks in this area that you might find interesting.

First, we have a stock that I picked yesterday for DP Diamonds subscribers. In DP Diamonds, I go through my scan results and find the best candidates to present to subscribers. I give out ten stock and ETF picks per week. The stock in question, PTCT, has broken from a declining trend. The RSI is positive and the PMO is rising toward a Crossover BUY Signal. Stochastics are also on the rise. Notice relative strength studies; the group is attempting to outperform again, and PTCT is outperforming both the group and the SPY.

I’ve opted to set the stop as close to support as possible without making it too deep. There is plenty of upside potential here.

VERV is breaking out from an intermediate-term trading channel. I like this breakout move. It is trying very hard to close above resistance. Given the positive RSI and rising PMO above the zero line on a Crossover BUY Signal, it looks like this breakout will materialize. The OBV broke out with price, so the rally is being confirmed. Stochastics are above 80. Relative strength is excellent for VERV against both the group and the SPY; we could see a little profit taking at this resistance level, but that would likely offer a good entry.

Conclusion: Biotechs are rallying and under the hood indicators are confirming the rise. We should see more upside out of this group, but, as noted earlier, this is an aggressive group and will likely require the market to continue making its way higher. Should the market turn on us, there won’t be too many areas that will be unscathed, but, for now, the rally is holding up.

The DP Alert: Your First Stop to a Great Trade!

Before you trade any stock or ETF, you need to know the trend and condition of the market. The DP Alert gives you all you need to know with an executive summary of the market’s current trend and condition. It not only covers the market! We look at Bitcoin, Yields, Bonds, Gold, the Dollar, Gold Miners and Crude Oil! Only $50/month! Or, use our free trial to try it out for two weeks using coupon code: DPTRIAL2. Click HERE to subscribe NOW!

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 Subscribe HERE!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2025 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)