Energy Replaces Technology

At the end of this week, 1/17/2024, the Technology sector dropped out of the top 5 and will be replaced by Energy. The ranking in the top 5 has also changed. XLY is still number one but XLF raised to the #2 spot, pushing XLC down to #3.

XLI rose to #4 and, as said, XLK dropped out of the top 5 to #6 while XLE moved up to the #5 spot entering the portfolio.

- XLY – Consumer Discretionary

- XLF – Financials

- XLC – Communication Services

- XLI – Industrials

- XLE – Energy

- XLK – Technology

- XLU – Utilities

- XLRE – Real Estate

- XLP – Consumer Staples

- XLV – Health Care

- XLB – Materials

I started adding the ranking for all sectors so it will be easier for us to monitor which sector or sectors are picking up and make a chance to enter the top 5.

Weekly RRG

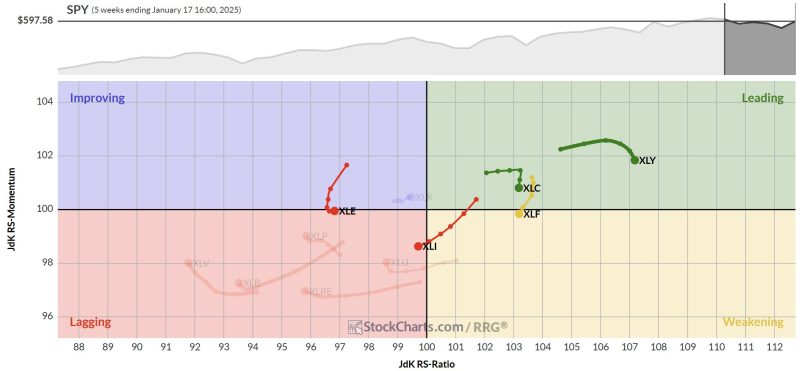

On the weekly RRG, XLY, XLC, and XLF remain firmly on the right-hand side of the graph despite their loss of relative momentum, which is causing the tails to roll over.

XLI has now crossed over into the lagging quadrant while XLE has started to hook back to the right on the edge of the lagging and the improving quadrants. The Technology sector remains inside the improving quadrant but is not able to make a real push for leading.

Daily RRG

The bigger shifts become visible on the daily RRG. XLE shoots into the leading quadrant while Technology moves opposite and enters the lagging quadrant. Combining these moves with the weekly RRG has caused the switch of positions for these two sectors.

The improvement of Industrials and Financials has pushed them up in the ranking while the weakness of Communication Services led to a drop, while still inside the top 5.

The strength of Consumer Discretionary remains, mainly from its strong position on the weekly RRG. The curling up of the daily tail will only help the sector remain inside the top 5.

Consumer Discretionary

The strong move higher this week could well establish a higher low and confirm the existing uptrend. Despite a small loss of relative momentum, with the green JdK RS-Momentum line dipping, the RRG lines remain firmly above 100, keeping the sector inside the leading quadrant.

Financials

This week’s strong move higher took XLF back above the rising support line which it threatened the last few weeks. The higher low is now in place and the raw RS-Line got a push in the back and bottomed out around the breakout level from the sideways range.

Communication Services

This sector held up well but is still back inside the boundaries of the rising channel. I am not the biggest fan of such moves but stepping aside and looking with a fresh eye this may well evolve into a flag-like pattern. Following the RRGv1 strategy, this is still one of the stronger sectors.

Industrials

Price bottomed out exactly against the rising support line after completing a small bottom formation. It now has plenty of upside room within the rising channel, and the RS line has put in a higher low, albeit shallow.

Energy

The Energy sector is the new kid on the block. On the price chart, XLE jumped from the lower boundary and is now underway to horizontal resistance around 98.50.

The raw RS-Line remains within the boundaries of its declining channel, keeping the weekly tail on the left-hand side of the RRG plot. The recent strength in the sector pushed the daily tail deep into the leading quadrant, far ahead of all other sectors. The combination of weekly and daily tail positions pushed XLE above XLK, entering the top 5 portfolio.

Performance

The performance of the best 5 sectors at the end of last week was 2.73% vs. SPY 2.21% (measured against the start of this experiment), hence a 0.52% outperformance. I will update the portfolio, adding XLE and removing XLK, against the opening prices of next week (which will be Tuesday!!!).

A note on weights

So far I have used equal-weight positions for this portfolio of the best 5 sectors. But while doing more research and running more tests I realized that that is not the correct way to do it.

Don’t get me wrong, the strategy works and the outcomes using equal-weight positions are historically positive, but there is a flaw.

This is best explained using the technology sector as an example. At the moment XLK makes up 31.6% of SPY.

So when I add XLK to the portfolio at 20% I am still UNDERWEIGHT 10% against the benchmark. In other words, when XLK is in the top 5, meaning it is one of the best 5 sectors, in the portfolio I am still 10% behind the benchmark and XLK is not able to contribute to the performance as much as it should.

On the other end of the spectrum is XLRE at 2.1% of the benchmark. So when I add that sector at 20% I am almost 10x overweight.

Compare that to the 10% underweight for XLK, and it’s not hard to understand that such a weighting scheme causes all kinds of shifts in this strategy’s risk-reward profile.

For now, I’ll continue with the equal weight scheme while working on a more dynamic weighting scheme based on the benchmark weights of the sectors that made it into the top 5.

Have a great weekend and #StayAlert. This week’s article is coming from Tampa, FL where I attended the CMTA mid-winter retreat. Next week I will be working from the Stockcharts.com office in Redmond, WA –Julius