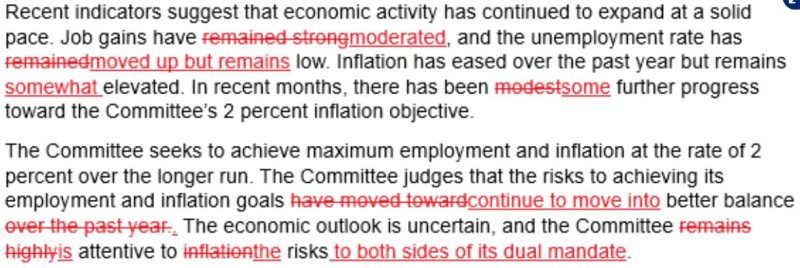

This Fed has got to go. It’s time. You’ve overstayed your welcome, Fed Chief Powell. I literally was just shaking my head after reading the changes to the Fed’s policy statement. The changes were in the first two paragraphs, so let me jump right in and show you what changed in the wording and, essentially, what the Fed acknowledged:

Wording in red with a line through it was wording from the prior policy statement that was not in the current policy statement. Wording in red and underlined is new wording in the current policy statement. I think the most important change is the last line in the second paragraph. At the prior meeting, the statement said the FOMC “remains highly attentive to inflation risks”. That clearly showed that the Fed was much more concerned about inflation than the economy. The economy wasn’t even mentioned. But the latest statement now reads that the FOMC “is attentive to risks to both sides of its dual mandate.” The dual mandate, of course, is to maximize employment (economy) and stabilize prices (inflation). So the Fed is now acknowledging that the economy is weakening, which is EXACTLY what I’ve been saying for the past several weeks. We dedicated an event last Saturday to this exact topic to warn our members of the deteriorating economy and what that could mean for the S&P 500.

It’s not pretty.

In order to avoid recession, the Fed needs to act and cut rates. But no, no, no, not this Fed. They’re still looking for a “sustainable” path to its 2% target on inflation, as if this chart doesn’t CLEARLY show a sustainable path:

I’ve been in the camp of a soft landing. Now I’ve decided I don’t like camping. I also don’t like this Fed, if you couldn’t tell. Not only did the Fed leave rates unchanged and fail to give us all a sense of security that rates will drop in September, but it was a UNANIMOUS decision. They’re all going along for this ride with the Fed Chief of Sustainability Powell.

Powell is in the business of creating pain for investors globally. His infamous speech from the stage in Jackson Hole in 2022 completely derailed a massive 700 point-rally in the S&P 500 over the prior 9-10 weeks. This isn’t new.

Do you know how many trillions and trillions of dollars trade every day in the U.S. bond and stock markets? There are BRILLIANT economists in the world’s largest financial firms and all of this money has been SCREAMING at the Fed to cut rates. But they have their own agenda and are the LEAST transparent Fed that I’ve ever seen. Would you like to see some immediate fallout from the Fed paying ZERO attention to the stock and bond markets?

How about this 5-day chart on the IWM (small cap Russell 2000 ETF):

Wednesday 3pm: The moment that Wall Street realized that all its hopes and dreams of a rate cut were crushed and that our economy is as good as gone. Soft landing? Very, very doubtful. The good news is that Christmas specials should be great this year as companies try to get rid themselves of massive inventories.

Listen, it’s not too late to get the recording from last week’s “Why The S&P 500 May Tumble”. It may turn out to be the most important video you watch this year. A FREE 30-day trial membership will do the trick. I laid out the path for the S&P 500 and key growth areas. The only thing I’d change, 5 days later, is the title. A more appropriate title would be “Why The S&P 500 Will Tumble”.

Also, I just recorded a YouTube video last night, “Fed Makes Wrong Move AGAIN!”. Be sure to “Like” the video and “Subscribe” to our YouTube Channel. I appreciate your support!

Sleep well Powell.

Happy trading!

Tom